What’s happening in the world of substrates that will give large-format PSPs an edge? Richard Stuart-Turner looks at what’s new, what’s unusual and what’s coming up.

There are few ways of more effectively making a print job great than getting the choice of substrate spot on. The good news is that those looking for something new or unique to differentiate themselves from the competition will find plenty of innovative products to choose from.

More and more materials and objects can now be printed, and developments continue apace when it comes to substrates more widely used in our sector.

Antalis UK head of channel sign and display, Chris Green, says a major current growth area for the company is easy-apply materials. “Whether it’s walls, windows or floors, people want to put these products up without any major fitting costs. It also saves them time, and time is money.”

The company launched a range of new Drytac easy-apply materials at The Print Show in October, including Spot On, ReTac and Rapid Air. Some of the new textured products in the Drytac range, including Textures Linen and Textures Canvas, also proved popular at the show.

“The market is moving towards more tactile products and more textures, things that work a little bit differently,” says Green. “A couple of the new textured products in the Drytac range have linen finishes and swirls and we have a wallpaper range in our Coala product line with different finishes and textures.

“We’re always looking for new and innovative products. Commercial printers who have invested in wide-format are constantly looking for new revenue streams and for something different to put in front of their customers. The tactile and textures makes people stand out from the vinyl and commodity type products.”

Antalis UK is not the only company seeing success with textured substrates. At Fespa Digital in March, Avery Dennison unveiled a range of permanent adhesive wall films in its MPI 8000 Wall Film series that included textured as well as untextured versions.

At the same show, Lithuanian manufacturer Veika launched three new textures in its Decojet Eco PVC-free digital wallcovering media range. Decoleather, Decosand and Decodrift have non-woven backing and a hot-embossed surface that can be directly printed onto.

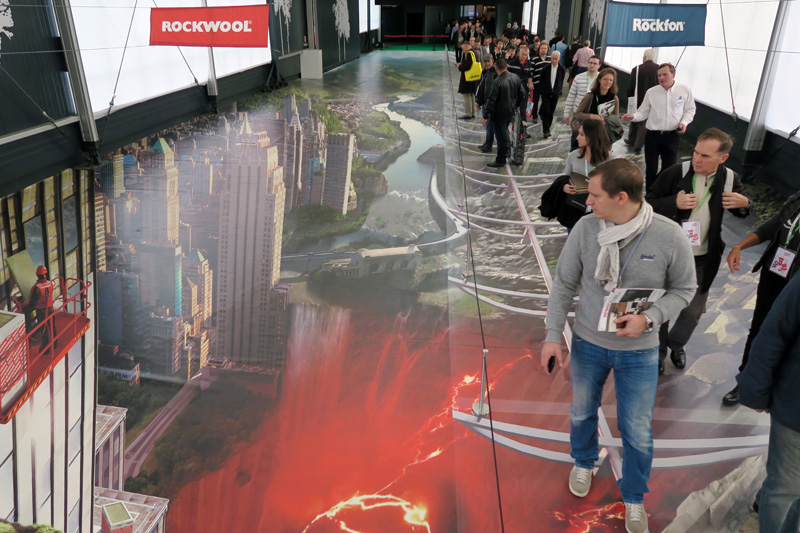

Proving just as popular recently is printable flooring and carpets. Soyang Europe sales director Andrew Simmons says marketers are increasingly seeking to exploit the relatively untapped potential of floor-based promotional graphics.

“We are going to be launching a new European-manufactured printed carpet product very shortly, featuring a gel-foam backing, providing excellent anti-slip and sound absorption properties as well as being 100% recyclable, which we anticipate will be very appealing in exhibition, conference and retail environments.”

Green says flooring is an area Antalis UK has also seen recent success in. “Within our Drytac and Coala ranges we’ve got standard products that you can print on and then put a slip-proof laminate on.”

In September we reported that the market for solar glare reducing printed perforated window graphics, which contributes to reduced solar glare and internal heat build up, is growing but as yet little exploited. Green says Antalis UK is currently looking more closely at the window tint market - with some films already available in the firm’s Oracal range.

Contra Vision has been successful in this field, with products including Contra Vision Performance film, and Soyang Europe also sees it as an opportunity.

“With their ability to provide privacy, block-out harmful UV rays and provide widespread promotional opportunities, window film products are becoming ever-more sophisticated as they seek to address the requirements of sectors such as automotive and transport as well as offices and retail outlets,” explains Simmons.

Canon UK business group manager for display graphics Dominic Fahy says the trend for printing on more unusual substrates and objects is also becoming more prevalent, meaning that more is being asked of printer manufacturers. “We get faced with things we’ve never thought of before, with customers printing onto musical instruments or electronic gadgets.”

Stuart Cole, national sales manager for industrial products at Mimaki distributor Hybrid Services, says Mimaki has come up with a solution for this trend. “Mimaki’s introduction of a printable primer has opened up a variety of more unusual materials to be printed to. Primer improves adhesion, cuts down pre-print processes and makes once unprintable rigid items a suitable surface on which to lay down a printed logo or brand message.”

But Fahy says the general trend seen by Canon, particularly with its Océ Arizona UV flatbed printers, is that customers often want to print onto more delicate or lighter media, which become dimensionally unstable with heat but are typically lower cost.

“We’re reflecting that on our machines by making the vacuum system more adjustable so you can have lighter media on there. We’ve also lowered the temperature of our UV curing lamps so there’s a broader range of media you can use and also use less energy as well.”

Soyang Europe’s Simmons says demand for more environmentally sound substrates is also still on an upward growth curve. “This is almost certainly fuelled by larger business operations and ‘household names’ keen to promote their environmental and sustainability credentials. This is now filtering down to smaller companies who are keen to play their part too.

“In the last six months or so we have introduced new products developed with our European partner, Endutex, which feature significantly enhanced environmental credentials.”

Another new and interesting ‘green’ option is Cygnus Outdoor Display, a water-resistant board produced by Swedish paper mill Oppboga Bruk and marketed exclusively in the UK by Swanline Paper and Board as part of its Cygnus range. This product, which is suitable for outdoor signage for up to 12 weeks, is unlike the synthetic alternatives commonly used for these applications - such as PVC and polypropylene - because it does not use a polyethylene (PE) coating to achieve its impermeable properties.

The substrate, which is coated on both sides to minimise deterioration, is FSC certified, contains up to 60% recycled fibre and is 100% recyclable. The 100% paper fibre composition of the product is said to enable high resistance to moisture, even compared to PE coated alternatives.

Last year Antalis UK started stocking Carbon Balanced Paper, an initiative administered by CarbonCo, in partnership with conservation charity World Land Trust (WLT), that balances the carbon impact of the paper that PSPs, paper-makers and distributors use through the work undertaken by WLT. For now this applies to paper but Antalis UK’s Green says the company is currently looking at ways to apply the carbon offsetting principle to a wider range of products.

“We’re working to take the good principles that we have out of our commercial print side of the business and apply that to the sign and display side. We’re at the beginning of that journey in terms of investigating what products this could be applied to but there’s no reason why it should stop at papers and can’t go on to things like plastics and PVCs.”

Now more than ever, then, it seems that the possibilities achievable with substrates are virtually endless, especially in large-format where printers and inks are becoming more capable of producing stunning results on even some of the most unusual materials.

And as Canon UK’s Fahy concludes: “The more interesting and unique the application, the more value that drives for the PSP. And the more applications you can offer your customers, the more you can sell and the more profit you can make.”

Printable textiles

One large-format area growing at a quicker rate than most right now is textile printing, and as Antalis UK’s Chris Green points out: “Direct inkjet printable textiles have moved on.”

He adds: “We’re starting to see more universal products now that can work across water-based, solvent and UV and they now print better and have better quality and print results in terms of vibrancy.”

A number of interesting substrates have been launched in the past few months that highlight the breadth of possibilities now available in this sector.

Dutch manufacturer Texo Trade Services launched Blackback - a black-backed textile which is said to guarantee 100% blockout - earlier this year.

This is becoming popular for exhibitions in particular, the company says, because exhibitors want to promote their branding or messages without external light sources from neighbours showing through the substrate. The 100% polyester knitted product can be printed with direct dye-sublimation, sublimation transfer and UV curable inks.

Also new are products from German manufacturer Pongs that are suitable for use as visual aids for merchandising and events. One of its more unique offerings is a new acoustic fabric aimed at the sound absorption market called Silencio, which the firm claims is the world’s first three-dimensional optical textile.

Neschen, meanwhile, has recently launched its Solvotex art canvas 380 printable canvas, a polyester/cotton fabric product suitable for banners, exhibitions, stage decorations and art reproductions.

Printable canvasses are also becoming particularly popular in the burgeoning home/interiors part of the textile printing sector, as more people look to personalise their homes.

Soyang Europe’s product portfolio includes a variety of dye-sublimation printable textiles. The manufacturer has just installed its own MTEX Blue dye-sublimation printer to ensure it can test its latest substrates in-house before bringing them to the market.

Soyang Europe’s Simmons says: “The development in textile technology shows no sign of slowing up as printed textile graphics become ever more popular in exhibition and retail applications due to their greater flexibility and ease of installation.”

Textile printer manufacturers work closely with not only substrate developers but also inks manufacturers to ensure that all three elements come together to produce the best quality print possible.

A recent Mimaki success has been the TX300P-1800 direct-to-textile inkjet printer, which is compatible for use with dye-sublimation, disperse dye, pigment, reactive dye and acid dye inks.

Stephen Woodall, national sales manager for textile and apparel at Hybrid Services, says: “The TX300P-1800 enables printing directly to cotton and other fabrics with pigment inks. These new inks give PSPs greater flexibility in the fabrics they can print to and offer one of the simplest textile printing techniques, with fixation achieved through direct heat or baking.”

Textile printing is an area with huge profit potential and one that we will be looking at further in our March issue, following January’s Heimtextil event in Frankfurt. Watch this space for more on this sector.

Pricing

Following the Brexit vote, an increasing area of concern surrounding substrates for PSPs is pricing. The impact is already being felt, with a lot of materials produced outside the UK now costing more to import.

Is switching to British-made materials therefore the answer? Canon UK’s Fahy says UK-based producers will be affected too. “Pricing is an issue for all manufacturers and even those that manufacture locally would still need raw materials from across the world.”

Soyang Europe’s Simmons adds: “It seems unlikely that PSPs will switch to UK–manufactured materials as in most cases they still carry a price premium that is difficult to negate, even within the current volatile currency markets.”

But Nick Hughes, national sales manager at specialist plastics manufacturer Brett Martin, headquartered in Northern Ireland, says switching to UK-made substrates could work out cheaper for PSPs in the long term. “At the moment there’s still a bit of a lag in the system in terms of pricing. Since Brexit, anybody manufacturing outside the sterling zone trying to get into the UK will be paying the change in the currency between the dollar, Euro and sterling.

“Coming back to UK-based manufacturers has therefore got to be a consideration. Unless our competitors are making excessive profits and can absorb it then the reality is that they will need to increase their prices in-line with what it’s costing them because of the currency change.”

Antalis UK’s Green says the company’s European scale can be used to its advantage. “We can use the wider volumes we’ve got to hopefully get the best deals and offset some of the issues we’re currently going through.

“It’s our duty to make sure we try to keep the market stable and ensure that we’re not fluctuating all the time in terms of pricing. That’s done through reviewing and working with our supply chain to make sure that any impact of any price changes is kept to the absolute minimum.”

Switching exclusively to British-made materials might also rather limit the choice available. With much of the current substrate innovation seemingly happening on the continent and further afield, it might mean missing out on some of the more unique and interesting products coming through.