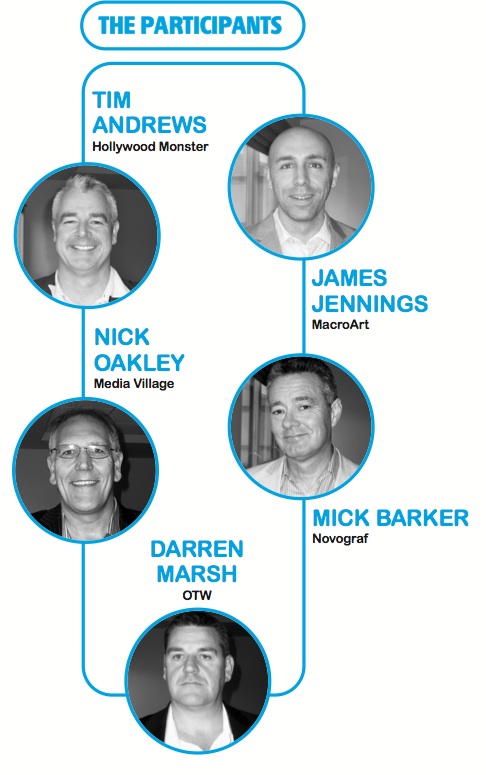

Grassroots players, Tim Andrews from Hollywood Monster, James Jennings from MacroArt, Nick Oakley from Media Village, Mick Barker from Novograf and Darren Marsh from OTW, discuss the findings of the annual Widthwise wide-format market survey and chew over the main issues of the day.

“If I could I’d ban the phrase ‘£1 cheaper’”. So said James Jennings of MacroArt to nods of approval from the other print business directors at this year’s Round Table discussion on the state of the UK wide-format digital print sector. In the four-hour meeting the panel provided plenty of thought provoking comment on the issues impacting players in this space, but at the end of the day, the overarching message was that it all comes down to price – and it shouldn’t.

“I was once told by my dad that if you ever win a customer or job on price, you’ll lose it on price and as a sector we need to realise that,” said Darren Marsh of OTW, to which Hollywood Monster’s Time Andrews relied, “Yes, it really devalues the business.”

These are messages we hear all the time, but the price of wide-format print – well, in the banner end of the market at least – continues to fall. So what’s really driving the prices down and how can the market at large retain the margins it’s used to? This proved a core topic at the Round Table, run by Image Reports each year to discuss the key findings of the magazine’s annual Widthwise Survey (downloadable at: www.imagereportsmag.co.uk/widthwise2012)

Of the 200 or so UK and Ireland companies involved in wide-format and surveyed this spring, 71.6% said they run other types of printers too. But almost two-thirds (63.9%) said they expect wide-format to become a bigger ratio of their work in the next two years; hardly surprising when you consider that it’s one of the most profitable print sectors. Last year 48% of respondents said wide-format margins were better than in other parts of their business. This spring it dropped to 43.3% - still impressive, but heading in the wrong direction.

So is that an indicator of things to come? Can we only expect margins to erode as the sector continues to draw new entrants and markets mature?

“I think the wide-format demographic is in the process of changing quite dramatically – and its effects will be as dramatic as PostScript had on pre-press. The barriers to entry in wide-format are all gone. There are cheap machines that are easy to use and people are willing to buy lower quality print. A lot of people are coming into the market from scratch with a different approach to cost base, margin expectation etc. than those who have been in print for some time. I think we’re still yet to see a massive shift in the amount of people using wide-format inkjet and it will be difficult for big, established companies perhaps to adopt to the new landscape and mindset of the incomers.” This was comment from Mick Barker of Novograf that got a mixed reception around the table.

“I haven’t really seen many newcomers in the market,” said Jennings. “We’re not a high volume producer, and maybe that’s where it’s happening.”

“Around Norwich, where we’re based, lots of small litho companies have bought into wide-format – bought little machines to produce roller banners etc. – all stuff you can do without really knowing anything. The problem for us, is that they’re applying litho prices to wide-format and eroding margin. They don’t have the finishing kit etc. that we do, and some of the quality is awful, but people who perhaps have never bought wide-format print are going to these guys and giving them a go because they’re cheap.

“We actually come from a litho background,” added Nick Oakley of Media Village. “We used to outsource wide-format but decided we were missing out by not doing it ourselves. We started pricing from a litho perspective but saw that we were doing ourselves no favour. The thing is, there are plenty of newcomers from litho coming into the sector all the time and that is affecting pricing in the market. These litho guys are only getting into large-format because their leaflet customers want the odd banner – it’s not a serious, strategic new business move.”

For Barker, new entrants from the litho sphere is by the by. “What will really impact on the sector as far as I can see are the new entrants used to dealing with images – so pre-press companies etc. I think we’re going to see a lot more involvement from that side of things. And then it’s about how these people are used to charging. I would question how people measure ‘margin’ for a start. With litho it’s straightforward really, but if you’re in wide-format - especially if you’re dealing with complicated one-off projects - you need to review what you mean by margin – it’s not just about print cost. It usually includes lots of management time, creative input, distance shipping etc. Maybe wide-format isn’t delivering the margin people say it is because they don’t measure margin accurately!”

“You’re right, we found that it was very difficult to apply the same measure of margin to litho and wide-format,” added Oakley.

“How you charge and what that means to your end margin is a really difficult one,” said Marsh. “Jobs often come in last minute and the nature of the job changes as you go through the process, so what you quote and what the end job costs could be two quite different things and that puts people’s back up so you have to make a call on what to swallow to keep clients happy.

“We know we can’t sustain the margins we were getting years ago. There are lots of new entrants who charge less and the economy means we are all under pressure. We beat up our suppliers to lower their prices so we can only expect our customers to do the same to us. We’ll keep doing more work for less money.”

“If you charge for ink on substrate, the market knows the value of that is dropping so they will push prices down for sure,” added Barker. “But that’s not all you can charge for. I know that at the front end of the job, clients expect anything called ‘pre-press’ to be free or built-in, so don’t call it pre-press, call it something else.”

Jennings backed-up the notion with: “If you have a visible component part of the job, like design, then you can charge for that.”

“We log every hour spent on every job and it’s frightening how much time is spent on pre-press – often hours. So now we have started to try and charge for it,” added Andrews, to be met with Marsh’s comeback: “The problem is you might think the artwork will take an hour to sort and quote for that, but when it comes in you find it’s taking hours. The problem is the client doesn’t like being charged more than they were expecting.”

“The real problem is perception,” added Andrews. “People still think of print as a price per square metre. As a sector, where print is increasingly only part of a job, we need to change that perception.”

“And we need to be clever strategically,” noted Jennings. “Price cutting has been an issue so we’ve had to diversify. We moved into dye-sub printing on textiles and it has worked for us.”

“Yes, it is all about being clever strategically. I suspect we’re stronger now that we were going into the recession. We’ve had to deal with problems and move past the issues and we think we’re now aligned for the future.”

Oakley added: “When we came into wide-format we drove prices down because we had the margin to do that and still be profitable. It took us a couple of years to realise that wasn’t a long-term sustainable move. The economy also took its toll in terms of us losing some big clients and being hit by bad debt. But we have adjusted things within the company so that we can cope better with this type of thing so we’re better positioned now.”

“I honestly don’t have any other major concerns about business right now,” was Marsh’s take. “We are a small team and can change and adapt. My only real worry is that people undervalue what we do. We’ve probably walked away from more jobs this year than any other because the last thing we want to do is cut prices – we’d rather add value. We will definitely see margin

decline and my concern is how quickly that will be. But I’m not really worried because we know it’s coming and we’re prepared for it. Wide-format is a growing market and life is pretty good.”

“Our business has not been profitable recently because of the amount of investment we’ve made in expansion,” admitted Andrews, “but we’re much more confident than we were this time last year. The work we’re taking on is more profitable than it was because we deliver a lot more value-added type work. Times are good.”

“However, we see so many companies go under then start up again with no debt. There needs to be stronger legislation there,” mooted Jennings to general agreement round the table.

Despite the economy, 51.1% of 2012 Widthwise survey respondents said they would be recruiting in the next two years (54% said this in 2011) – the priority being print production, sales/marketing, design, finishing. So what did the discussion panel make of the data?

Jennings was up first: “We have made sure our team is multi-tasked to get where we are now. We’ve just recruited another sales person and we will be increasing our installation team.”

“We too have a new sales guy on board,” said Marsh. “At the moment we run a single shift and we’re aiming to increase that so we’ll be looking for production people too. We had 11 people at the start of 2012 and expect to have 14 by the end of 2013.”

“We’re right in the middle of recruiting now – across sales, pre-press and installation,” followed Barker. “The interesting thing is that if it was in litho we’d have been looking for people with five-years experience. But now we’re looking at apprenticeships and bringing in new people. Fewer and fewer staff will be focussed on putting ink on substrate.”

This was a sentiment echoed by Andrews: “In Birmingham it used to be hard finding someone with the right experience to run the printers, but we needed that experience. Now, not so much. We’re now focussing on other parts of the business because actual print production is a reduced part of our turnover. Funnily enough, that won’t be in installation though as we sub-contract that. When we need a team we need a big team so we don’t want to keep that on our books and pay for time you’re not using.”

“We do try and have out own installers,” responded Barker, “because most of our prints need to stay in-situ for a long time.

“We also want our own installers because we like them to talk to the clients and feedback what they’re saying at the end of the job,” added Jennings.

“I think this is where strategic partnerships could work quite well,” said Marsh. “It would be good to have a network of people spread across the whole of the UK that you could tap into and use when needed. Sometimes I have to travel miles to hand a banner – it’s ridiculous!”.

So what about the idea of strategic partnerships in general – and should we expect to see more of them as wide-format print companies continue to diversify? According to the Widthwise survey this year, 61.8% (66% in 2011) said finding new markets and offering new services was still a high/very high priority to grow turnover and margin. These reasons came ahead of diversification to differentiate the company from competition – interesting as many companies are involved in the usual key markets (display graphics, posters, banners etc.). Only 10% said they are involved in textile print and 6.9% anything to do with industrial speciality print.

“I’d like to say we’d been strategic in diversifying, but what we’ve done at Media Village has been very much client led. We started installing for example, because there was a call for us to do that. The whole point behind Media Village is that it’s a linking of companies via strategic partnerships so that each can do what it does best for the good of all. We went this route to protect ourselves actually. We’d had outsource partners before who had let us down so we wanted to de-risk the business by going this route.”

“We work with other companies on certain jobs, but trust can be an issue,” added Jennings. “From a diversification point of view we took the decision rather to invest in dye-sublimation printing in-house. It was a gamble, and it was six months before we got it really right, but it’s paid off for us, bringing in a mixture of new clients and converting existing clients to textile. About 20% of our turnover is now from textiles. Last year we doubled our profit, and that was mainly via textile print.

Barker said that Novograf has “spent the last 18 months to two years trialling new processes and applications. 2012 will see our highest ever level of exports and we’ve targeted new areas like the transport sector where there is scope for a complicated service/product offering.”

For Marsh and Andrews it’s more a case of stick with what you know. “I don’t feel the need to explore other markets. We can make more money by doing more of the same,” said Marsh.

“We’re in a similar position to that – doing more of what we know we can do,” added Andrews. “We have already diversified from being a sign business into the wide-format solution company we are now – that’s been a huge learning curve. We are always looking at new things, including dye-sub and even screen technology – but we’ve not found an argument for going those routes.”

So what about the argument for producing higher margin niche products?

“It’s too time consuming and we’re too small to put the right level of resource into it,” argued Marsh. Similarly Andrews noted that “We don’t do anywhere near what we could do. There’s not a specific R&D programme within the company to investigate niche product – though there are tax advantages to doing that!”

Jennings however, pointed out that MacroArt did invest in taking on a chemist to produce a lacquer for signs. “That’s been a very worthwhile exercise – a point of differentiation.”

And for Barker, niche product is what it’s all about. “Around 90% of al the substrate we sell is what we have developed with our suppliers to allow us to add niche products and deepen our level of sales – it’s our lifeblood and our positioning.”

From a technical perspective much discussion centred on latex given that in the Widthwise survey, that came out as the wide-format inkjet printer technology most wanted. 50.5% of respondents said they expected to buy a new WF printer in the next two years, with 37.4% saying latex was on their list, followed by UV flatbeds (35.4%).

Three of the five Round Table panellists already own latex (Marsh, Andrews and Oakley) while the other two have decided against buying the technology; Jennings because MacroArt instead chose the dye-sub route to textile printing, and Barker because he’s not had great results from ink adhesion tests and is unconvinced of its environmental credentials.

At the Round Table, the pros for latex came out as the ability to leave the machine running unattended for long periods of time, ability to finish immediately after printing and ease of use.

From the panellists’ point of view, short-term equipment investment will more likely be in UV flatbeds, with Marsh, Jennings and Oakley all looking in that direction.

“I think there is massive potential still for wide-format and companies will continue to invest in technologies that give some opportunity for a good return on investment as part of a well thought out strategic business development plan,” voiced Barker.

“But I don’t think wide-format should think it has any more of a right to expect to be any more profitable going forward than any other part of the industry. It will be market driven because that’s how markets work. And right now the market is looking at other technologies to deliver temporary images. It will be imperative that companies assess new competition and develop strategies to take that into account.”

Image Reports will be conducting its sixth annual Widthwise survey in the new year. If there are specific topics/issues you would like to see included please contact the editor Lesley Simpson. Email Lesley.Simpson@imagereportsmag.co.uk

The 2012 Widthwise Report is available for download at www.imagereportsmag.co.uk/widthwise2012