This has been the year of the ‘great reset’ for so many UK businesses, and the majority of those in the large-format sector are looking towards 2022 with optimism. Aren’t they? This autumn we ran two Round Table discussions - one with print chiefs, and one with suppliers - to find out if much had changed since the Widthwise 2021 poll at the start of the year, and before we kick-off the next one in January. This was the upshot…

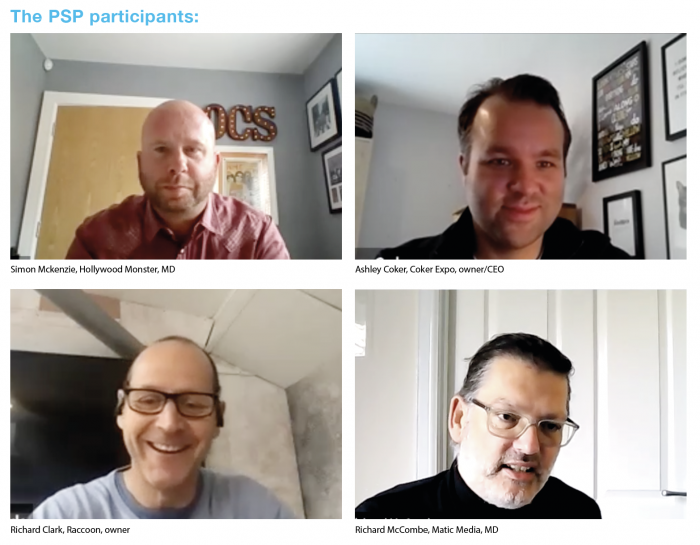

At the start of this year we polled 195 UK-based large-format PSPs for our annual Widthwise research. It showed that what has been the worst of times for some, has been the best of times for others in the sector. I took some of the key Widthwise 2021 survey findings as the basis of two Round Table discussions held at the end of September - one with PSPs and the other with the Widthwise Report 2021 sponsoring suppliers - to gauge grassroots feelings as we head towards a new year. Up first is what the print chiefs had to say.

How have things been for your business?

Mckenzie: That ‘D-Day’ when the chancellor first came on TV and explained his rescue package [in response to the Covid outbreak] came just at a point where it seemed our customers had fallen off the face of the Earth. We had to try and reinvent ourselves and find a new niche. We did a lot of PPE, floor graphics etc. and I’m pleased to say that during that May to October business flew, amazing considering that 80% of our traditional clients weren’t spending. From November it slowed down and December to March were the worst in our 30-year history. Hollywood Monster is a team of 45-50 post-pandemic, with a turnover of between £9m - £10m. Overall we’re about cash neutral from the start of the pandemic to now.

Clark: Raccoon was established in 1992 and our focus is on vehicle graphics/wraps, plus we have an offshoot called Promohire through which we hire out vehicles for promotional use with an appropriate wrap and conversion each time. We suffered most over the first four or five months [of the pandemic] because a lot of our work has concentrated on the events industry and promotions, and that all went. We didn’t make a big effort to chase the social distancing signage market, rather, thanks to the furlough scheme, we used it as a time to evaluate the company and what we wanted to be as we moved forward. We restructured the business, slimmed down what we were about and focussed on where we think the opportunities are. The beginning of 2021 was quiet as we came out of lockdown but we’ve been very busy ever since. This year, in terms of profit and turnover, I think we’re sort of where we were in 2019, and draw a line under the fact that 2020 was a disaster.

Coker: I took over my father’s business last year just before the pandemic. As the name suggests Coker Expo is mainly an exhibitions supply company with a large-format photographic background, and so when Covid hit it was really concerning. We did what we could with the pandemic related products but saw everyone was doing the same thing and quickly realised it wouldn’t be enough to prop us up. Luckily, I don’t draw a salary from the business as it’s not my only one, so we could use the time to innovate for the time when we’d come out of the other side of Covid, which we’re now starting to see. I’d say I’m cautiously optimistic now.

What do you see now as the key challenges for your business, and the sector as a whole?

The rising cost of supplies was giving most (85.64%) of those polled the biggest headache at the start of 2021, followed closely by the UK economy (83.6%). What are your biggest concerns now?

Mckenzie: What we’ve learned is not to have too much of your market share in one particular sector. About 40% of our sales are from exhibitions, and when they stopped our business stopped. I suppose my main concern is whether the market will get back to the same size that it was before. There’s a lot of capacity in the market, with many printers hunting for work and dropping their prices.

Clark: The thing is we’re not just looking at materials costs rising, we’re looking at global inflation across everything. Interest rates are going to go up too. We’re not in a position to absorb inflated costs so I think the thing is, we’re going to have to be able to pass those increased costs on as quickly as possible to customers and then just suck it up.

Coker: I agree with the above, plus just the complexity of being in business right now from a technology perspective is concerning. Print companies are being told to be more dynamic and offer more - with a nod here to textiles, packaging, hybrid printing - but it’s an increasingly software driven world and companies need to translate all this into an ever expanding print market. So to answer the question I think we need to invest in software, and in getting and training IT staff.

What’s your chief focus?

As you might expect, growing turnover came out top in the poll. Is that your own main priority?

Mckenzie: Service is what we’re all about at the moment. More than ever you’ve got to stand out from the crowd, and because there’s so much capacity in the market we’ve got to make sure that clients feel so loved that they couldn’t imaging working with anyone else.

Clark: For me it’s about chasing efficiencies in the business, and more automation right across the whole spectrum - projects that we’ve been working on over the last 18 months. And maintaining margins is a big focus - so, what is our target market and who are the customers we want in that market?

Coker: I think that as a relatively new entrant to wide-format print, our focus is what does it mean to be a print company in the digital era, when success is not necessarily measured by the quality of your product but how you stand out on a thousand different digital channels? How do we give customers a good experience, whilst also being eco friendly and sustainable, all at the same time? Having come from a software background, my focus in how to apply software across my print business.

McCombe: Matic Media, which also has a brand called Graphic Warehouse for trade print, is very focused on how we use technology in large-format print. For the last three-and-a-half years we’ve been trying to turn our business from a traditional large-format signage company into a more software-led, wider commercial large-format enterprise. By May or June last year we found our stars had come into alignment following all the Web-to-print development we’d put into the business. Since then we’ve seen orders start pouring in and our customer demographic has really changed, plus our profitability has improved because we’re much, much more efficient.

To what extend are you diversifying?

Nearly four out of ten of polled PSPs said that, by 2030, large-format print would no longer be their core business. Yet almost two out of three said they expected demand for wide-format print to return to pre-pandemic levels in the short to medium-term. That’s a bit of a conundrum, so do you see the biggest opportunities for growth within or outside of wide-format print?

Mckenzie: The problem is that nobody knows the capacity going forward. What I can say is that the customers we’ve traditionally had long-standing relationships with have been through a very difficult time too, so their balance sheets aren’t what they used to be. The difficulty for us is that about £4m-£5m of our sales is from customers in that bracket and we’re having to have the kinds of conversations with them that we’ve never had to have before. We obviously want to support them, but there’s only so far we can go financially to do that. The thing is it’s early days in terms of bounceback in what’s our core sector, and I think we need another few months before we see how much we need to diversify.

Clark: When it comes to diversification we’ve always been looking at the next opportunity and how to add value to what we do, whether that be in customer service, in extending our additional print services, or where print is secondary to a new service, as with our promo vehicle hire. There are times when we’re providing more of a creative service than a print service. We’re doing more in terms of helping people manage their brand - for instance we’re setting up more portals for customers so their own staff can access a broader range of marketing materials - and it’s there that we’re really charging, and the print may be smaller margin. So that’s how I see us moving forward.

Coker: I think diversification can be a dangerous game if you get it wrong. But I think one thing that seems certain is that we need to be more focussed on customers’ digital journeys. So I suppose I’d say we’re not so much looking at diversification as digital transformation.

McCombe: We are always looking at other things that we can ‘plug-in’ to our business. The whole point of setting up Graphic Warehouse was to trap smaller users of large-format and then get them to buy more. So our focus has been getting more products in our online offering while streamlining the workflow. We have something like 125,000 combinations now in our system, and in terms of diversification for us now it’s about adding in even more products and that will come through relationships with other companies to create an ‘Amazon’ type platform where customers can get lots of things, and we’ll be managing that.

What do you think about the changing shape of the WF sector over the next couple of years?

For one in ten, acquisition and merger was a priority for 2021/22. We’ve seen relatively few so far. Will the big groups buy-out many of the small-mid-sized players and commoditise LF print, with smaller boutiques setting up to do really bespoke/unusual work?

Clark: Merger and acquisition aren’t a concern as far as I’m concerned. I don’t think a corporate is going to throw a few million quid at me to sell-up! I don’t think this is the kind of industry where outside players are looking in. Harking back to diversification, there may be a company that sees the strategic value in buying up a specialist operation, but otherwise acquisition is only going to come from failures.

Coker: Having acquired my business in 2020 that sort of clarifies my position, but it was my father’s business - and I’m not interested in acquiring anything else at the minute, but I would welcome the opportunity to talk to people about that if it fit into the digital transformation journey.

McCombe: We have some gaps that we want to fill, and we might look at acquisition. But we went down the route of a possible acquisition a few years ago, and to be honest, I felt I was out of my depth. I’m OK with accounts and things like that, but I just couldn’t see how the numbers would work. But, I’m on the board of Print Scotland, and the print industry up here is still in a lot of distress, and over the last few years we’ve seen quite a lot of mergers and acquisitions, and I can’t see that stopping. There is an organisation in the north of England that is buying up signage and display print companies north of the boarder at a rapid rate, so maybe once you work out how to do it, it can be a good way to grow.

We hear constantly about the opportunities in vertical markets such as interior décor and various ‘industrial printing’ applications, but according to our data UK-based PSPs in this sector are hardly falling over themselves to invest in them. What’s your take on that?

Clark: I suppose that if you’re already in those vertical markets you’re probably going great guns, but it’s hard for a general large-format printer to move into them. They are niche, so how do you reach those markets - do you tie up your sales and marketing attempting to do it etc? You might buy a printing machine as bit of punt then wonder why you did it! Looking at something like interior décor from my perspective is a no no. We don’t get approached to do that type of work, ever, so we’re not going to start hunting for it.

Coker: I understand exactly what Richard is saying. You can’t just make a decision to start printing, say, garments - not when the mainstay of your business is banners and boards. You might have the kit and skill to produce products to cater to the needs of such customers but it’s getting to them. Maybe newer, younger, more specialist companies will better service those requirements.

McCombe: If you’re looking for new repeat customers that you can scale out of, then if you’re looking at interior décor in the B2C market you’ve got to invest a lot of money to get that one customer on board. The ROI doesn’t work. You can go B2B and get a partner get the C but I just can’t see how you can make the repeat work.

We are often reminded that this sector needs to embrace W2P more rapidly than our data suggests. Only 1.56% said they’d be investing in it across 2021/22. What are your feelings about W2P right now?

McCombe: We don’t use W2P because we’re targeting consumers wanting a personalised canvas - it doesn’t pay - but we do use it to target repeat buying trade customers that are personalising in the sense that their orders are unique. Getting their files into our workflow efficiently is paramount, and that’s where W2P comes into its own for us.

Coker: I think W2P is part of the future, but on the whole I don’t think large-format printing and digital transformation have met yet. To keep it simple, I think the companies that invest in W2P will succeed, but I don’t think the timing on when to do it is clear. I think as customer journeys become more digital centric personalisation will go with that, and there’s no point trying to do personalisation without W2P, but it’s not straightforward.

Clark: We recognise that we have a wide-range of customers and some just want to pick up the phone and chat through a job. At the other end of the spectrum we have those customers that never want to pick up the phone and only deal with us electronically. We need to work out how we make it easy for any type of customer to connect with us efficiently, then that the job is managed efficiently in as automated as way as possible, and that the customer finds it easy to track what’s going on and then reorder. So we are constantly looking at finding the most efficient, most profitable routes, including W2P.

Are you spending, and if so where and why?

Investment in new technology in general is pretty flat. Nigh on two-thirds of respondents said they would spend under £20,000 on large-format technology in 2021/22, and more than three-quarters will not invest at all in software or finishing kit. And why, given that improving efficiency is a ‘must do’ for many PSPs, did less than one in ten plan invest in Industry 4.0 technologies for smarter working?

Clark: We’ve invested a lot in the last few years - in software and other technology - and we’ve doubled down on that in the last 12 months. It’s costly, time consuming and not without pain, yet I think it’s essential if you’re to have a business in five years. I think change in our industry is happening that fast - and your competitors are investing. We are spending so that we can take advantage of the opportunities that will emerge in 2022.

Coker: I think that being just into the large-format print game, we made some significant investment, but on a more general note I think Industry 4.0 is a step too far for most at the moment. I think people don’t know what that means, and I think we need to be aware of newer entrants to the market who may be more digitally savvy and be automating and using remote diagnostics etc. from day one. I think the need to invest in software is necessary, but that the path is not so clear.

McCombe: On first thought I was thinking we’d not really spent money on anything over the last year, then I actually realised that everybody’s got a new laptop, everybody’s got a new handheld device that allows them to communicate across the building. We’ve done a lot of work on our CRM and recruited a software person to do some more work there, we’ve invested in third party consultancy to support us with digital marketing, so we are spending money on developing the company, it just isn’t necessarily on hardware.

With all the net zero pledges now being made publicly, the environment has become a crucial focus. Where does this sector need to focus its attention to become a greener part of the whole value chain?

Over 70% of polled PSPs said it has become more important for them to be seen as environmentally friendly than it was two years ago. What might be more surprising, is that 43% said few clients ask to see these credentials/ policies, and 21% said none do. Where do we go from here?

Coker: People want to be seen as environmentalists of course, but that hasn’t yet translated into operating differently in what is typically a hugely wasteful industry. Clients sort of assume that if they’ve buying exhibition graphics they’re going to be throwing them away afterwards so I can understand why they don’t look for eco credentials. But, we will start to see more succeed who put this first, and that requires major change on top of recovering from the pandemic and investing in the digital future. We’re doing our bit by only using certified eco inks and safe recyclability mechanisms on our printed products as well as using sustainable materials. But we all have a lot further to travel.

McCombe: I feel that people still just do not care enough to drive green change through the industry. Everybody says they want to do it, that they should be doing it, but actually doing it is slow. We’ve just done work for COP26, and we weren’t asked one question about the materials we’d be printing on, the inks we’d be using - and then the week before the event someone said ‘oh, do you have an environmental policy?’ I said yes, and started explaining quite loosely and they just went, ‘yeah, yeah, that’s fine’. Most of our customers are SME’s and if the big guys really aren’t going to push, the little ones certainly aren’t - it’s still all about pounds and pence. We can talk in detail to customers about how various media can be recycled etc - they don’t want, it. They don’t care. Until central government makes demands it isn’t going to filter down the chain.

Clark: Within my business there is a lot of waste - that’s the industry we’re in. It’s getting better, and there are lots more eco materials out there to print onto, and we do. We don’t wait for the client to tell us to use those, we are constantly trying to source more sustainable media and pass on that information. I suppose my bugbear is greenwashing, and customers that are flagwaving but aren’t really serious about the environment. For instance, we get asked to print on non-PVC, which we do, but then I know that goes straight into landfill at end of life. The person responsible for taking the graphics down hasn’t been told it can be recycled. It’s not something we, as a small, business, can do much about. The whole supply chain needs to come together, which I’m sure will happen over time.

How optimistic, or not, are you now about your own business - and for the large-format print sector in the UK?

Back in the spring of 2021, a fear of further lockdowns, worry over paying back Government loans, uncertainty about UK economic bounce-back were all flagged up as reasons for sleepless nights, yet there was great optimism too. Is that still there?

Clark: I’m quietly optimistic about my own business. We’re not a big operation - we have about 20 staff - and everyone is working hard, but we do have winter to get through, and I don’t think that’s going to be brilliant. I think, as always, we’ll have a slightly reduced turnover compared to the summer. But we haven’t got lots of debt, and by the time we get to spring 2022 we should all be in a better place. I expect to see the floodgates open in the all areas we all feed off, and get back to proper planning cycles.

Coker: We’ve used the Covid period as a chance to transform and we are optimistic to a degree, but cautiously so. There’s a lot to think about - sustainability, new technology etc.

McCombe: I call myself a pessimistic optimist - it’s garbage today but it’ll be great in the future. We had an OK summer, a really good September and October, November will tail off as usual, December will be utter garbage, so will January and maybe February, and by the time the events industry opens back up again in March - fingers crossed - then things will come back with a bang. I spend a lot of time looking at analytics and I think 2022 is going to be really, really good.

What the sponsoring suppliers said

Having heard from PSPs we held another Round Table, this time with the 2021 Widthwise sponsors, for a suppliers’ perspective on the state of the market. I again based the questions on the survey findings, and here’s how they responded.

Firstly, how would you describe the state of the wide-format printing market in the UK over the past year?

Grauf: My first reflection is on how innovative and resilient the sector has been. On the whole, I’d say the wide-format industry is on the up - people are taking this time to create new products. Also, when people had no option but to sit at home, they took stock of their businesses and looked at how to increase their profitability, and I think that’s a good way of going into the next few years.

Jones: The sector has obviously been under a lot of pressure. The lack of events/exhibitions and closure of retail outlets had a significant impact, but we’ve seen the sector be very adaptable in responding to pandemic conditions. So the market has been quite resilient and we’re still here.

Green: I’d say the market has been resilient and stoic. At the moment it’s reanimating. When you roll the clock back to March 2020 I think we all took a deep breath and feared where the market would be going. But not long after we started seeing a resurgence of business as people started doing PPE and floor graphics. And now we have found a new pace in the market

The 2021 Widthwise survey shows that the cost of supplies is a primary concern for print service providers. What have the cost pressures been like for you? Have you raised prices? And do you expect the pressures on supply chains, costs and prices to change in the year ahead?

Grauf: Price increases are a concern for us as well as for our customers. What we’ve seen in terms of freight, and lack thereof, has forced our hand at times. Raw materials have gone up, impacting the cost of manufacturing machinery not just consumables. We have had to ask ourselves if we need to increase prices, and unfortunately the answer has been yes. Looking ahead, the problem is that things are so unpredictable that we just don’t know if we’ll need to increase prices further or keep them as they are.

Jones: Yes, raw materials costs, and availability, remain under pressure. We’ve seen price increases this year, and we’ve been in a situation where we’ve had no option but to pass those on to customers. We try to remain as competitive as possible, but as we see it, there’s no stability when it comes pricing for the foreseeable future. Added to this, is a climb in distribution costs, and driver shortages are an issue too. Then there are the things you don’t expect - like the recent fuel shortage. Managing the supply chain is a constant battle at the moment, and sadly I think we can expect to see more price increases in the first half of 2022.

Green: I think what we all want to see is some stability, and it just isn’t there at the moment. There are so many interlinking things impacting pricing - Brexit being one. Whatever you think of Brexit the extended lead time to get goods into the UK has to be acknowledged. Also, you need to look at other aligned industries and the impact of things like the plastic tax - the latter means people are turning away from plastic to use pulp-based alternatives, which in turn causes a shortage of pulp-based materials, driving those prices up. Then there are the act of God factors across the globe…. At some stage things will settle down, but I think we’ll see more increases in 2022.

Eco-sustainability is a more important issue than ever. How are you ‘greening-up’ your own business?

Green: This year has been a big one for use in terms of sustainability. We launched a green manifesto that states our intentions, and we have a couple of initiatives to go alongside that - one of them being a star rating system for materials to indicate how eco-friendly they are. We’ve put a lot of working capital into improving our profile and products. If you look at the packaging sector and see what’s happening there in terms of a move away from plastics etc, I think we can see how it will go in the visual graphics market and we’re working hard to deliver. I wouldn’t claim we’re perfect at Antalis, but I think we know where we need to go.

Jones: Back in 1998 we were one of the first in our sector to gain ISO14001 for environmental management, and we’ve worked to that standard ever since. We are always looking at eco initiatives - so, for instance, back in 2009 we did a full LED lighting refit in all of our warehousing. We now have electric charging points in all of our key locations and we’re encouraging all of our drivers to go electric. As soon as it’s practical to do so we’ll change our transport fleet to electric vehicles too. And we’re a partner with the Woodland Trust so that our customers can mitigate their CO2 emissions from the products they buy from us. So far we’ve raised over £1.2m and planted around 25,000 trees. We are trying to be as green as possible.

Grauf: Here we’re manufacturing goods that require quite a fair bit of energy and a lot of raw materials. For all our factories we try to procure locally. Also, at out sites in Belgium for instance, we have water treatment plants because we use quite a lot of water there. What we’re trying to do too, is take small steps that we can implement quickly to make a difference - one of them being putting solar panels on the roof of the factories. We won’t be able to be energy self-sufficient but as we go forward hopefully we’ll generate more and more of our own. From a distribution angle, we are tying to reduce the number of trips we need to make from country to country too.

Where do you think the sector as a whole needs to be making more/quicker ecological advances?

Grauf: On the technology front, in wide-format, we’ve been producing machine that allow our customers to be greener - starting with reducing the amount of ink needed to print a product, not just due to the amount of ink needed on the substrate, but the ink needed to keep printheads functioning etc. We’re cutting ink needs by reviewing how we make the ink, push it through the printheads, and by reducing waste via the software that drives colour profiles and so on. Also, the switch to LED wide-format machines allows users to significantly reduce energy consumption.

I think we also need to make strides in managing waste in relation to printed products once they’re finished with by the end user. The industry as a whole needs to look into proper recycling methods that are simpler and more affordable than those we currently have. It needs joined-up thinking between all parties.

Green: Companies need to not only be thinking about recycling, but how they run their businesses as a whole and minimise their environmental impact. I think some may get quite overwhelmed by that - but small steps matter, from changing the lighting to LEDs. Anything a company can do to mitigate its carbon footprint is good. Also, take a look at your suppliers and ask how eco-friendly they are. It’s about making the whole supply chain more environmentally responsible.

Jones: There are so many considerations. When it comes to product selection I reiterate that there are greener solutions out there now and as an industry I think we need to do more to educate around that. And there’s never been a better time to look at those greener solutions from a cost perspective to try and help their wider adoption. I too think we do also need to do more on the recycling front as an industry - at this moment in time there’s not a solution for everything and we need to come together to look at that. From a technical perspective, I think an area that needs particular attention is self-adhesive media - we need a product that is recyclable.

Many wide-format print service providers think that the major technological breakthroughs have already happened in their sector. Do you agree?

Grauf: There’s always room for improvement. There is some extremely exciting technology coming down the line that makes printing more sustainable. We’re aware that ecology can’t come at the expense of economy, but we have very intelligent people who will be able to combine the two. I think by Fespa 2022, maybe 2023, we’ll see some real major steps forward in terms of technology.

Green: Compare the early Ford cars to today’s Teslas - who would have guessed at the strides that would have been taken in car technology. There are always improvements to be made. Is there going to be a big bang thing coming our way - probably not, but we will see an evolvement in technology to make printing greener.

Jones: We have relationships with printer manufacturers because our media needs to work with their kit, and I anticipate that there will be stuff that hasn’t come through yet, and may be groundbreaking - we just don’t know. The move from solvent to UV for instance was warmly accepted and that’s been around for a while now so we’re looking out for the next big thing.

How would you describe the outlook for the wide-format printing market in the UK over the coming year? Do you expect the sector to quickly bounce back to pre-pandemic levels here?

Jones: We’ve already witnessed resurgence in terms of media volumes being bought. We anticipate that as events and exhibitions continue to open up, as the high street comes back and sports stadia fill-up, that trend will continue.

Green: It’s all about confidence. Covid hasn’t gone away, and people are nervous, but advertising and promotional work is coming back so there are signs that things are picking up. If we can get past Christmas without another lockdown I am very much hoping things will really start coming back. Plus, there are other things coming down the line - the switch from diesel to electric will drive in fleet graphics and things like that - so there will be new market opportunities too.

Grauf: I hope that we are back to pre-pandemic levels by the end of 2022, and even surpass that. We hope for the best and prepare for the worst. I do sincerely hope we have a more stable run from here on in and don’t get pulled back again with Covid. It’s worth bearing in mind that the wide-format side of print has bounced-back so far much quicker than it has in ‘conventional’ print. I think PSPs in this sector can wake up more optimistic than in they can in others.

Videos of the Widthwise Round Tables in full can be found at:

https://bit.ly/3CNzj9b and at https://bit.ly/3byTlI8.

In January we’ll be doing Widthwise survey all over again – but in the meantime, if you haven’t already done so, you can download the 2021 report from the Image Reports website at:

https://www.imagereportsmag.co.uk/widthwise