Dye-sub is having a catwalk moment. If you’re going to any of this year’s print shows you can expect these printers to be in the spotlight as manufacturers seek to benefit from the rise in fast fashion. Simon Creasy brings you up to speed on developments.

One of the industry sectors that has found itself abruptly thrust into the spotlight over the last 12 months or so thanks to the Extinction Rebellion movement and wider consumer awareness of the climate crisis, is fashion. More specifically ‘fast fashion’. By their very nature the trends that these fast fashion retailers are trying to tap into are transitory and they go out of fashion as quickly as they have come in.

The practice of rapidly producing huge volumes of inexpensive clothing that is typically manufactured thousands of miles away from the market in which these products will ultimately be sold in response to these transitory trends runs counter to the pervading consumer sentiment surrounding sustainability.

It is not a good look for an industry that is a significant contributor to climate change. Annually, the fashion sector produces 20% of global wastewater - dyeing textiles is the second largest polluter of water globally - and 20% of global carbon emissions - more than all international flights and maritime shipping combined.

So it is little wonder that the fashion industry has slowly but surely started to green-up its act. A major beneficiary of this shift in sentiment and more eco-conscious strategy is the dye-sublimation print market. Fashion retailers still want to rapidly produce their products in response to trends, but they want the capacity to manufacture them closer to home - thus cutting down on aircraft and shipping emissions - using more environmentally friendly techniques. Step forward large-format digital dye sublimation printers.

The step change in attitude was visible for everyone to see at the Heimtextil exhibition held in Frankfurt last month (January). The overarching theme of the show was sustainability with ‘green pioneers’ in the textile industry given a platform to showcase their wares.

According to industry sources, demand for dye-sublimation print has steadily been on the rise for the last few years, but the fashion industry in particular is really fueling its current and future growth trajectory.

“On a global basis we believe the textile market is going to continue to grow thanks in part to the focus on the fashion market for being fairly environmentally unfriendly,” says Phil McMullin, UK sales manager, pro graphics, at Epson UK. “One of the ways they can improve their impact on the environment is to produce more stuff locally in the market where it is going to be sold and the only way you can do that is through digital print really. The traditional way of producing 8,000 units in China and then shipping it back to Europe is not going to work any longer so digital print is going to continue to grow in the UK and Europe as re-shoring gathers pace.”

Fashion may be one of the big dye-sublimation growth areas at the moment, but Michael Lewis, channel account manager at HP, says that decor, on demand production and personalisation are also all boosting the growth of digital textile print.

“The digitally printed textiles market is experiencing double-digit annual growth, forecast to reach $5.5bn by 2023, according to research by Smithers Pira,” reflects Lewis. “At Heimtextil it was exciting to see the industry’s reaction to new and innovative applications made possible in interior design with HP’s digital printing technology.”

The big focus for his company in this particular space at the moment is the HP Stitch S series, which includes the Stitch S1000, a super-wide dye sublimation printer that launched at Fespa last year. He says the 3.2m machine brings a “new level of innovation to high production companies” offering fast speeds, high uptime and unattended shifts.

“HP’s expansion into the textiles industry demonstrates our commitment to making digital printing accessible to all,” says Lewis. “The super wide HP Stitch S1000 removes major complexities from dye-sublimation printing, with industry leading technology and high-quality prints at unrivaled speed. The HP Stitch S1000 unlocks the power of colour for production environments through smart technology.”

Meanwhile, Epson is busy promoting the three latest models that have been added to its growing portfolio of dye-sublimation printers. Towards the end of last year Epson launched the 24in-wide SureColor SC-F500 that McMullin says can be used for anything from textile sampling through to the personalisation of mouse mats. The machine is targeted at small businesses in particular and according to Epson offers “fast turnaround times, reliability and a low total cost of ownership”. McMullin adds “the SureColor SC-F500 has really only just started shipping so it is still early days, but we are expecting great things”.

The company also announced the launch of two 64in dye-sublimation printers last year - the SureColor SC-F9400H and the SC-F9400. According to McMullin, the printers have been primarily developed for the fast, high volume printing of clothing, textiles and soft signage, in addition to other merchandise. The SC-F9400H also has the option of printing fluorescent yellow and pink, to allow users to service the sportswear and workwear market. A demo unit recently arrived at Epson’s Hemel Hempstead office and McMullin expects the machines to start shipping in the near future.

Another new machine is Mimaki’s Tx300P-1800 MkII hybrid digital textile printer that offers direct to textile and transfer capabilities and was unveiled at the ITMA exhibition held in Barcelona last year.

“As we head into 2020, we anticipate seeing the new Tx300P-1800 MkII printer hit the UK and Irish markets during the spring where we predict it having a substantial impact thanks to its breadth of capability,” says Brett Newman, chief operations manager at Hybrid Services, Mimaki’s UK and Ireland distributor. “Market demand for flexibility - both in industry and within education - is substantial and the new Mimaki is a direct response to this requirement.”

Newman explains that the MkII, which is an evolution of the Mimaki TX300P-1800 direct to textile model, offers printers “enhanced versatility in terms of fabrics, applications and targeted markets”, and gives smaller print service providers and colleges and universities the opportunity to provide a full range of textile printing applications with just one system.

“Lowering the barriers to entry and delivering a highly flexible solution is core to this new hybrid model,” continues Newman. “There are also opportunities for larger setups to benefit from its ‘buddy’ capability, providing broad flexibility and strong production volumes for ‘non-standard’ output without interrupting high speed digital production systems.”

He says that the introduction of the new hybrid machine was driven by market demand for “quick turnaround, flexible production of short runs of high quality textile print”. These factors were also taken into consideration at HP when it started working on the creation of the Stitch portfolio.

“One key area where we are seeing customer demand is the drive for greater automation,” says HP’s Lewis. “Advances made as part of ‘industry 4.0’ mean that customers can rely on shorter turnaround times and greater productivity. Our approach to dye-sublimation printing takes this into account, with our HP Stitch S1000 offering fully automatic maintenance, which ensures optimal image quality without user intervention, while saving time with easy media loading and unloading by a single operator.”

McMullin anticipates the factors Lewis outlines will continue to determine the shape of future dye-sublimation NPD brought forward by equipment manufacturers over the coming months, with Epson poised to unleash more products in time for a big reveal at Drupa.

But while McMullin remains bullish about the future outlook for the digital dye-sublimation market thanks to the growing use of these presses by home furnishing brands and fashion houses who are looking to boost their environmental credentials, he says there are some lingering issues that may well hold back future growth of the sector.

“One of the skillsets lacking in the UK at the moment is on the finishing side,” says McMullin. “While it is relatively easy to bring print back to the UK [as part of a reshoring drive] if you understand colour and design, what is proving more challenging when we talk to people in the textile industry is finding people with the requisite finishing skills. As a result, people are having to train up seamstresses, for example. Also if you are making personalised furniture you need upholstery skills and not a lot of people can do that either, so that is where the skills gap is at the moment.”

Where there definitely isn’t a gap is in the wide range of dye-sublimation equipment on offer at the moment. Epson intends to continue to flex up and down offering dye-sublimation machines of differing sizes that build on the company’s established technology to ensure the portfolio offers a model that meets all user’s needs.

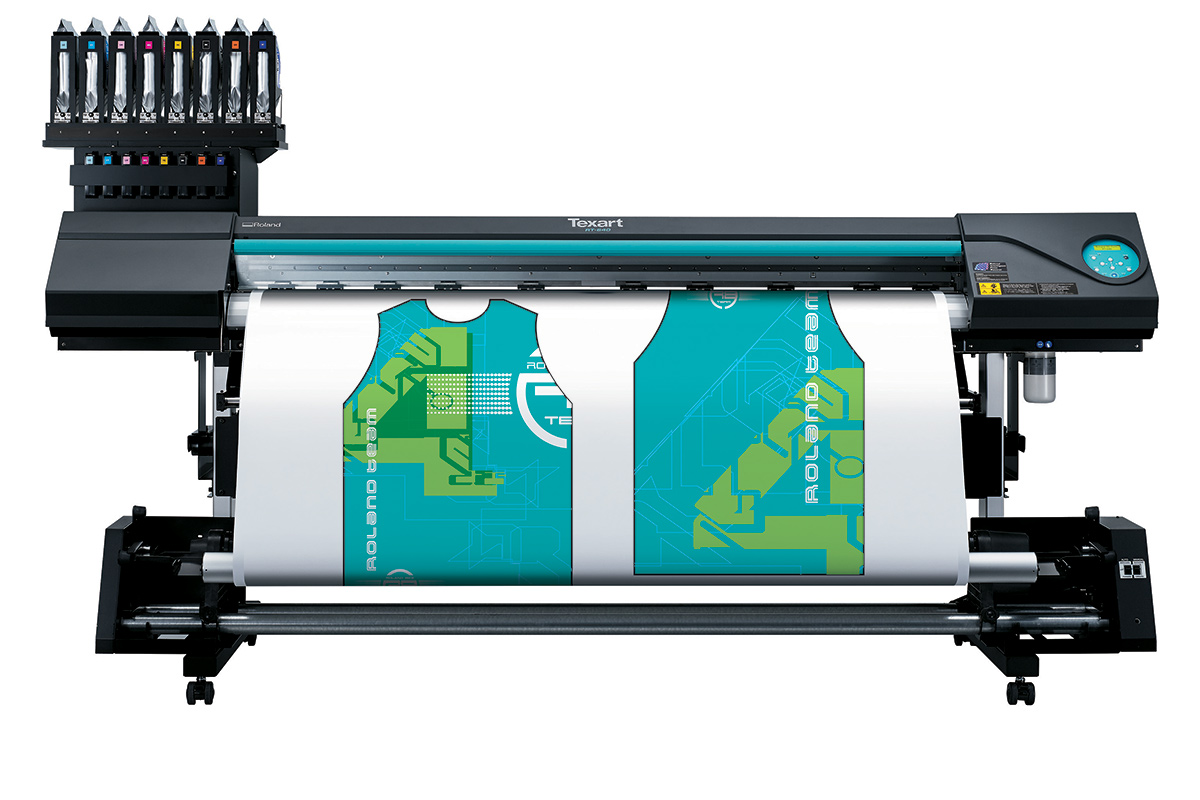

It is a philosophy shared by Roland DG, which is currently marketing the RT-640 and the XT-640 dye-sublimation printers - the company’s latest development is the RT-640M, which allows for printing both onto sublimation paper and direct-to-textile.

“Although it is by no means a new technology, research and development in dye-sublimation continues to uncover new opportunities,” says Paul Kerins, marketing content executive at Roland DG. “New materials are constantly being added to an already extensive range which expands the possibilities for developing new applications. Again, with the benefits of these digital methods, product designers are finding innovative ways to incorporate dye-sub technology in their manufacturing processes.”

He adds that although things like branded mugs and promotional goods still form the backbone of most dye-sublimation businesses, the emerging textile markets offer plenty of scope for future growth.

“We’ve noted a significant rise in popularity for interior décor products in recent years,” says Kerins. “In this market, there is a demand for bespoke items as customers’ design tastes become more and more individualised. There’s growth too in the retail and hospitality sectors with companies seeking to brand every element of the customer experience. In both these cases, dye-sub businesses can produce bespoke curtains, upholstery, tablecloths, cushions and soft signage.”

The latest generation of dye-sublimation printers are opening up new markets to a wider range of print houses, as more and more business recognise the benefits of switching from traditional printing techniques to digital printing. As competition in the market intensifies Kerins believes this will fuel even greater take-up of dye sublimation technology in the future.

“As their competitors benefit from the additional speed and flexibility of digital printing, there is a lot of pressure on our customers to adapt to the faster pace in the market today,” says Kerins. “Although a demand exists for products crafted using traditional methods like screenprinting, in most cases the end-customer is more concerned with the final product than the method used to produce it. For the most part, it makes business sense to invest in digital equipment even if it’s just in addition to a predominantly traditional workflow.”