Catherine Cresswell and Ron Gilboa of Keypoint Intelligence consider whether UK PSPs not rushing headlong into apparel printing are missing out.

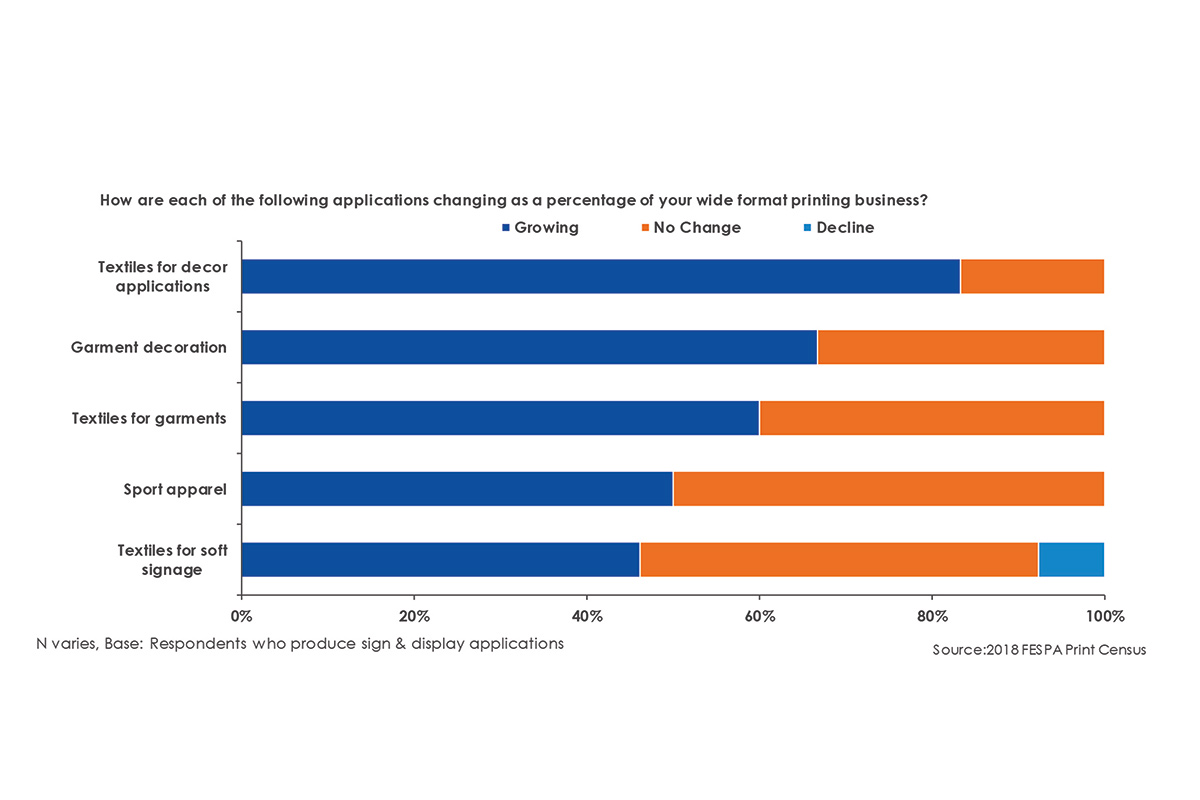

As a wide-format PSP in the sign and graphics sector, is there a real opportunity to produce digitally printed apparel and/or decor textiles? Globally collected data from the 2018 Fespa Print Census conducted by InfoTrends (part of Keypoint Intelligence) indicates that sign shops are (see chart below). Furthermore, when asked what features they would like of future printing devices, 39% said textile printing capability, and when asked about specific technologies, 13% expect to purchase dye-sub equipment in the next two years, and 7% said equipment with other textile inks.

But does this mean they are all moving into sports apparel or home decor applications? The 2019 Image Reports Widthwise survey indicates that in the UK most companies are not - so are they missing a trick?

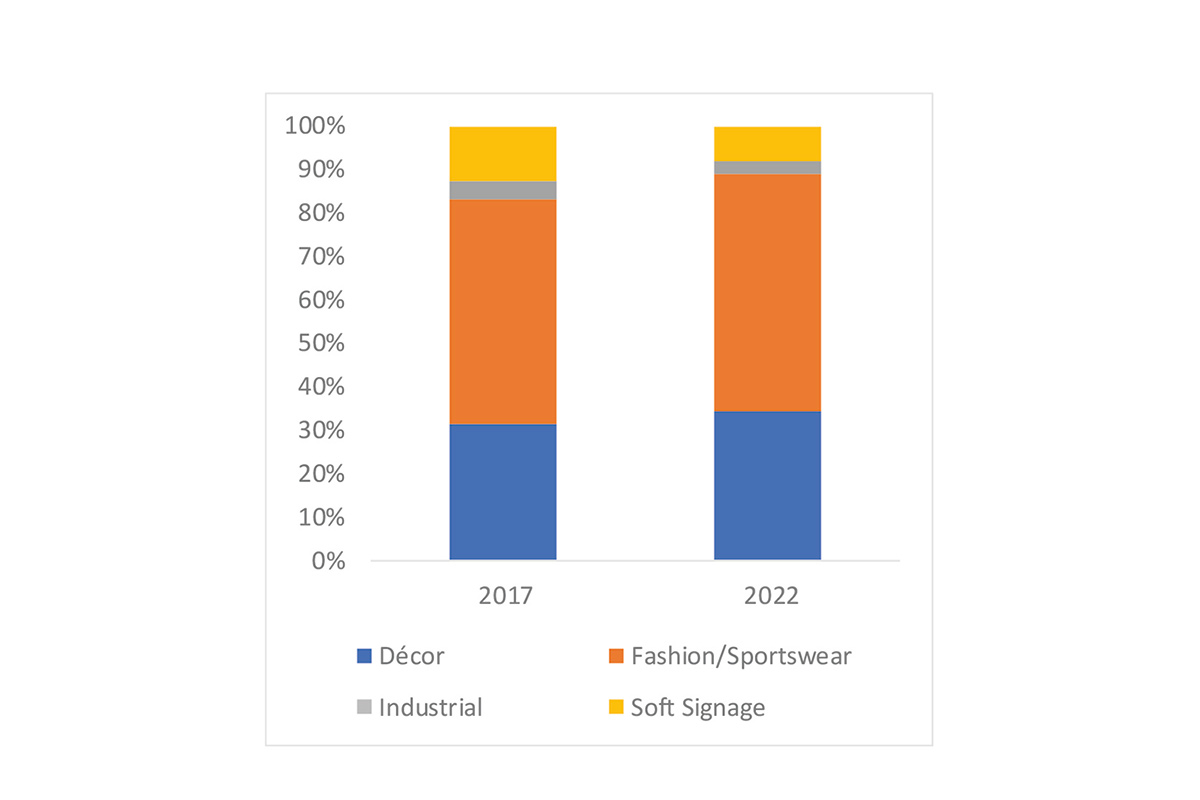

In print volume terms the applications beyond soft signage are growing at more than double the rate of those in textile-based signage. The EMEA market as a whole is expected to grow by 15% per annum to 2022 - soft signage at 4%. Signage is also more vulnerable to replacement by electronic display in the longer term, whilst stats show that Europeans are still increasing the number of items of clothing they have and will not be replacing them with electronic versions! Increasingly their desire is for customised, even personalised versions, and often purchasing is online which points to a growing mass customisation trend fulfilled with digital print solutions.

Home decor such as soft furnishings, bed linen, upholstery and window furnishings are also on the up, not least because in the online space users are experimenting with new shopping tools to help link them with the products they are most interested in (source: InfoTrends’ Digital Textile Printing Forecast).

The recent Fespa UK textile conference saw an interesting mix of independent, even start-up designers, and wide-format printing companies. The designers were looking for printing companies that could produce samples or show them fabric choices - the printers wondered if they would be paid for the swatches if engaged by a designer? These are interesting questions that need to be worked out to enable the digital textile printing revolution to really take off in this part of the market.

The supply chain when it comes to fabric printing is challenging too. On the one hand brand requirement for standard production and colour matching are very demanding. On the other, not all fabrics are made the same and require different inks to meet the standards for permanency such as washability and crock among others. In many cases a PSP may need to invest in multiple machines to meet client requirements for printing onto varying types of fabrics (see table below).

If you are a PSP asking ‘is apparel/decor printing for me?’ consider:

- Is there a fully articulated business plan that details the addressable clientele for apparel or décor, together with a keen understanding of the process steps and transaction financial structure?

- Does the operation have the skillset and tools for producing, and selling, output in a range of fabric types?

Some sign shops have taken the plunge - Probo in the Netherlands is a case in point. It invested in a Durst pigment printing machine and set up a new subsidiary called motiflow.com, an online portal for designers to store their designs and sell online - with orders fulfilled by Probo.

Keypoint Intelligence believes that the demand for local on-demand production will continue to grow and that printing technology and fabrics will become readily available. For sign shops and wide-format PSPs with the right technology, skillset and entrepreneurship, apparel and decor print offers opportunity. However, the complexities of the supply chain, accompanied by pressure on margin by large brands, compounded by the need to provide ancillary services such as cutting and sewing, may prove insurmountable to some would-be players.