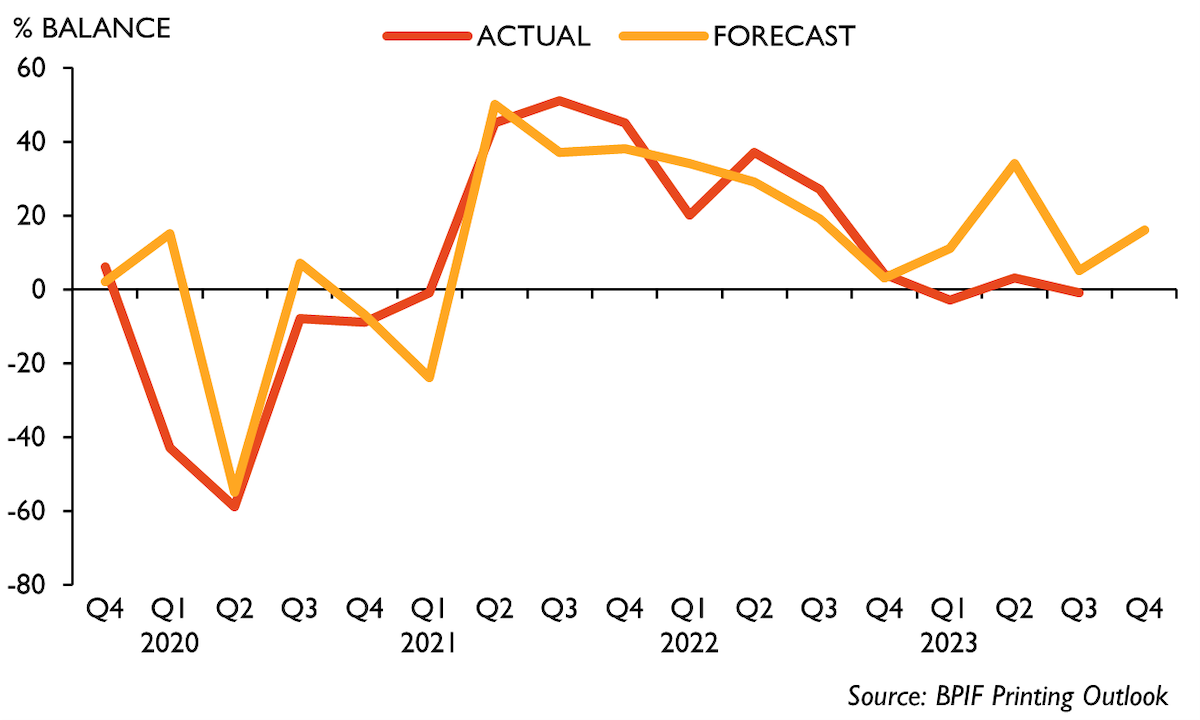

The latest Printing Outlook survey from the BPIF reveals that one-third (33%) of printers managed to increase their output levels in the third quarter of 2023, whilst another third was able to hold output steady. The Q3 results extends the flatlining period in output growth to four quarters.

Forecasts for Q4 are for an improvement in output growth, though it may be more of a case of fewer companies experiencing declining growth rather than a significant seasonal boost. Output growth is forecast to increase for 36% of companies - 44% predict that they will be able to hold output levels steady in Q4. That leaves 20% expecting output levels to fall. The resulting balance forecast is +16 for the volume of output in Q4.

The BPIF said the Q4 forecast is welcome yet underwhelming for a period that under ‘normal’ circumstances would be expected to experience a stronger seasonal boost. Whilst an under-performing economy, with cost-control a paramount concern and increasing pressure to accelerate digitisation in some client markets, presents challenges to some sectors, there are still growth areas within print. Further falls in inflation and a lowering of interest rate expectations will do much to improve business confidence and performance expectations.

Concern over sales levels has become the new top business concern for printing companies. Rising from third ranking last quarter, concern over the level of sales replaces competitor pricing as the most selected business concern. Competitor pricing still attracted significant attention, it was selected by 53% of respondents, down from 56% previously –-it is just that concern over sales levels has surged from 41% to 57%. Companies are having to adapt and work differently, or harder, to maintain and grow sales in markets, and with clients, that are also changing rapidly.

Wage pressures, now the third ranked concern, was selected by 52% of respondents, up from 35%. Most companies conducted their pay reviews earlier in the year; however, concerns do remain over wage pressures and the effect of the next round of minimum wage increases, and more importantly the knock-on effect that has on wage structures and pay differentials throughout businesses. Continued stubborn inflation, and the effect that has on pay review demands, means wage pressure concerns will likely become more prominent early in 2024.

Charles Jarrold, BPIF chief executive, said: “It has been a challenging year so far, but it is pleasing to see an uplift in confidence and expectations for the final quarter, even if it’s not quite in line with what might be considered a normal seasonal boost.

“The survey newly reports on uncertainty levels, thankfully they are now expected to stabilise and, with more than three-fifths of the industry with an excellent, or good, cashflow position, there is well-founded hope for the period ahead. A period in which many companies will be looking to exert further control on their costs and explore what diversification options they are well-place to take advantage of.”